Why fixed mortgage rates are on the rise

Sadly, the days of ultra-cheap money are seemingly long gone. Because while you could find fixed-rate loan options starting with a ‘1’ just six months ago, many options are now priced in the mid to high ‘3s’.

That’s despite the fact the Reserve Bank of Australia hasn’t hiked the cash rate in more than a decade. Lenders don’t always base their home loan interest rate pricing on what the RBA does or doesn’t do. That’s because they’re independent, so they don’t necessarily have to raise or cut interest rates in line with the central bank.

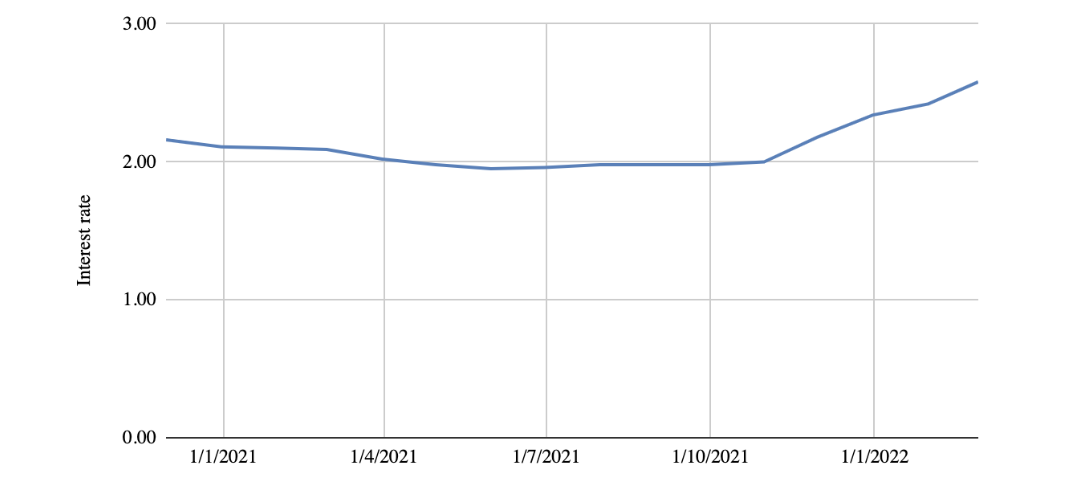

For example, take the graph below, which shows how the average fixed rate for new borrowers on terms less than or equal to three years has fluctuated since November 2020 – even though the cash rate hasn’t moved during this period.

Average fixed-rate for new owner-occupiers (terms less than or equal to 3 years).

What causes ‘out-of-cycle’ rate changes?

When lenders do their own thing, it’s known as an ‘out-of-cycle’ rate change.

Out-of-cycle rate changes reflect the fact that a lender’s funding costs can go up or down even when the cash rate is steady. That’s because the cash rate determines nothing more than the interest an Australian bank pays on money it borrows overnight from other Australian banks.

These overnight loans aren’t the only way Australian mortgages are funded. Lenders also raise funds for their fixed-rate products by issuing bonds in the international money markets. Bonds are like an ‘IOU’, in which an investor agrees to lend money to an institution in return for regular interest payments.

The interest rates charged on bonds are known as ‘yields’ – and, recently, they’ve been rising. Higher bond yields mean higher borrowing costs for lenders. These, in turn, are passed onto Australian borrowers in the form of higher rates on fixed-rate products.

Is it better to go variable?

Speculation has been brewing that the Reserve Bank will lift the cash rate sooner rather than later. For example, all four big banks have pencilled in the first of several cash rate hikes to begin in June. So another reason why fixed rates have been rising is that the market has already priced in these future rate rises.

This leads us to the obvious question: should you fix your home loan now or is it better to go variable? There’s no one answer, as it depends on your unique circumstances. A good mortgage broker can talk you through all your options. At Eventus Financial, we’re proud of being the best finance brokers in Sydney. Schedule a no-obligation consultation with Alex today.